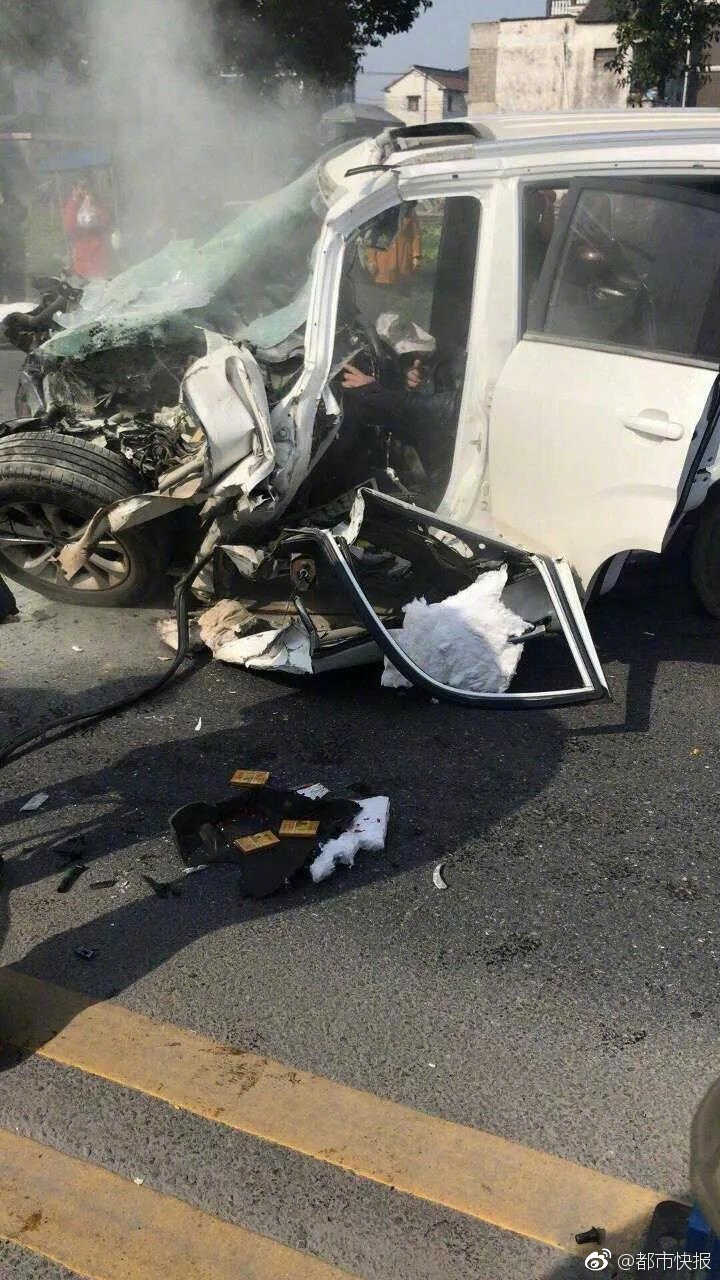

1. Vehicle insurance generally requires traffic insurance, vehicle loss insurance, third-party liability insurance, vehicle stop loss insurance, and scratch insurance. Among them, traffic insurance is a must-buy insurance according to national law. Traffic enforcement insurance Traffic enforcement insurance (full name compulsory motor vehicle traffic accident liability insurance) is the first compulsory insurance system in China prescribed by national law.

2. Traffic enforcement insurance Traffic enforcement insurance is the basic type of insurance in vehicle insurance. It is compulsory insurance, and all private cars must be purchased.The main function of traffic enforcement insurance is to compensate for third parties' casualties, property losses and other related expenses in traffic accidents.

3. Generally, car damage insurance, third-party liability insurance, car personnel liability insurance and their additional insurance will be purchased. Commercial vehicle insurance: including vehicle damage insurance, third-party liability insurance, vehicle personnel liability insurance and additional insurance, which provide protection for the vehicle itself, the third party in the accident, the occupants of the vehicle, the absolute deductible and the scratch insurance of additional insurance.

4. You can buy three types of car insurance: traffic insurance, three-party insurance and car damage insurance. The following is a specific introduction to car insurance: Traffic enforcement insurance: Traffic enforcement insurance is the insurance that every car owner must buy according to law. When a vehicle has a traffic accident, it can have the most basic insurance claims.

5. Vehicles generally buy traffic insurance and commercial insurance. Commercial insurance includes vehicle damage insurance, three-party insurance, non-deductible, etc.

1. The 4 insurances that must be purchased for a car are: traffic enforcement insurance, third-party liability insurance, vehicle personnel insurance, and non-deductible insurance.

2. The four types of insurances that vehicles must purchase are: traffic compulsory insurance: traffic compulsory insurance is compulsory insurance purchased by the state. It is a compulsory liability insurance in which the insurance company compensates for the casualties and property losses caused by the insured motor vehicle due to road traffic accidents within the liability limit, but does not include the personnel on the vehicle and the insured.

3. The 4 types of insurance that must be purchased for car insurance are: traffic enforcement insurance. It is a compulsory insurance, and the owner of the car must insure his motor vehicle. If the owner drives on the road without buying traffic insurance, he will be severely punished after being investigated and punished by the traffic management department.And without purchasing traffic insurance, motor vehicles cannot be inspected annually.

4. Theft and robbery insurance can provide funds for the car owner. In summary, although there are many types of car insurance, traffic enforcement insurance, third-party liability insurance, vehicle damage insurance and theft insurance are the four most necessary types of insurance. When purchasing car insurance, car owners need to carefully consider their actual situation and protection needs, and choose a car insurance plan that suits them.

Buy the most suitable car insurance method: first buy traffic insurance; full third-party liability insurance: all car insurance types of third parties are the most important.

The most cost-effective way to buy car insurance 1 Be sure to choose a regular insurance company 2 Traffic insurance is a mustThe insurance types that must be bought are also important to be considered regardless of deductible for car damage. Of course, there are many types of insurance, such as a series of additional insurances such as wading insurance, spontaneous combustion insurance, theft and robbery insurance, because the actual probability of occurrence is negligible.

If the car owner usually drives less often, you can choose insurance based on third-party liability insurance. If the owner often needs to pass through traffic jams when driving, it is recommended to buy separate glass breakage insurance. This kind of insurance is more comprehensive and can be selected according to different situations.

You can not buy scratch insurance, spontaneous combustion insurance, wading insurance and non-deductible insurance. The car owner can choose according to his own financial ability. The second purchase channel is the most cost-effective. The price of car insurance purchased on the official website of the insurance company is the most cost-effective. Generally, it is 15% or 30% cheaper than the purchase through normal channels. Secondly, you can choose a phone car. Risk or go directly to the insurance.

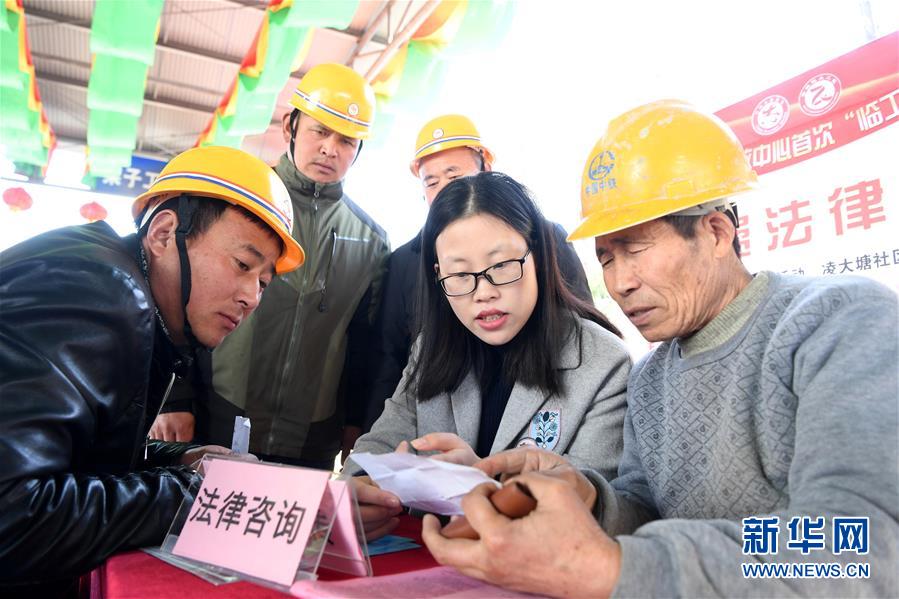

The first method: compare the quotations of different insurance companies. Consumers can enter vehicle information and personal information through the official website of the insurance company or the website of a third-party insurance company to obtain quotations from different insurance companies. Compare the prices and insurance terms of different car insurance companies, and you can choose the most suitable insurance plan for yourself.

Car insurance can be purchased mainly through 4S stores, insurance company business hall, insurance company official website and telephone. If you are not familiar with driving skills and the value is in the middle and low gear, choose a higher third-party liability insurance, and the vehicle personnel liability insurance is more comprehensive. I am not familiar with the driving skills, and the cost of vehicle wear is moderate.

There are many types of car insurance, thisBuy samples to avoid stepping on the pit. As there are more and more vehicles on the street, the probability of traffic accidents is also increasing. In order to protect ourselves, we will choose to buy insurance for vehicles.

I don't think it's cost-effective to buy all of them, but it's not so reassuring not to buy them. Therefore, it is very necessary to understand the function and purchase needs of car insurance, so as to save money and rest assured.

1. The first method: compare the quotations of different insurance companies. Consumers can enter vehicle information and personal information through the official website of the insurance company or the website of a third-party insurance company to obtain quotations from different insurance companies. Compare the prices and insurance terms of different car insurance companies, and you can choose the most suitable insurance plan for yourself.

2. Compare more, choosing full insurance is also a good choice. When buying insurance, compare the prices and services of several insurance companies to find a suitable insurance plan for yourself. Generally speaking, full insurance is the most comprehensive, but the premium is higher. But sometimes, choosing full insurance may be more cost-effective than choosing individual insurance.

3. How to buy car insurance in the most cost-effective way? Novice plan: compulsory insurance + car damage insurance + third-party liability insurance + vehicle personnel liability insurance + non-deductible insurance + separate glass breakage insurance + scratch insurance + can't find a third-party special insurance; this plan is relatively expensive, but it can not only compensate others, but also accidentally commit Mistakes can also protect your own losses.

App to watch Champions League live free-APP, download it now, new users will receive a novice gift pack.

1. Vehicle insurance generally requires traffic insurance, vehicle loss insurance, third-party liability insurance, vehicle stop loss insurance, and scratch insurance. Among them, traffic insurance is a must-buy insurance according to national law. Traffic enforcement insurance Traffic enforcement insurance (full name compulsory motor vehicle traffic accident liability insurance) is the first compulsory insurance system in China prescribed by national law.

2. Traffic enforcement insurance Traffic enforcement insurance is the basic type of insurance in vehicle insurance. It is compulsory insurance, and all private cars must be purchased.The main function of traffic enforcement insurance is to compensate for third parties' casualties, property losses and other related expenses in traffic accidents.

3. Generally, car damage insurance, third-party liability insurance, car personnel liability insurance and their additional insurance will be purchased. Commercial vehicle insurance: including vehicle damage insurance, third-party liability insurance, vehicle personnel liability insurance and additional insurance, which provide protection for the vehicle itself, the third party in the accident, the occupants of the vehicle, the absolute deductible and the scratch insurance of additional insurance.

4. You can buy three types of car insurance: traffic insurance, three-party insurance and car damage insurance. The following is a specific introduction to car insurance: Traffic enforcement insurance: Traffic enforcement insurance is the insurance that every car owner must buy according to law. When a vehicle has a traffic accident, it can have the most basic insurance claims.

5. Vehicles generally buy traffic insurance and commercial insurance. Commercial insurance includes vehicle damage insurance, three-party insurance, non-deductible, etc.

1. The 4 insurances that must be purchased for a car are: traffic enforcement insurance, third-party liability insurance, vehicle personnel insurance, and non-deductible insurance.

2. The four types of insurances that vehicles must purchase are: traffic compulsory insurance: traffic compulsory insurance is compulsory insurance purchased by the state. It is a compulsory liability insurance in which the insurance company compensates for the casualties and property losses caused by the insured motor vehicle due to road traffic accidents within the liability limit, but does not include the personnel on the vehicle and the insured.

3. The 4 types of insurance that must be purchased for car insurance are: traffic enforcement insurance. It is a compulsory insurance, and the owner of the car must insure his motor vehicle. If the owner drives on the road without buying traffic insurance, he will be severely punished after being investigated and punished by the traffic management department.And without purchasing traffic insurance, motor vehicles cannot be inspected annually.

4. Theft and robbery insurance can provide funds for the car owner. In summary, although there are many types of car insurance, traffic enforcement insurance, third-party liability insurance, vehicle damage insurance and theft insurance are the four most necessary types of insurance. When purchasing car insurance, car owners need to carefully consider their actual situation and protection needs, and choose a car insurance plan that suits them.

Buy the most suitable car insurance method: first buy traffic insurance; full third-party liability insurance: all car insurance types of third parties are the most important.

The most cost-effective way to buy car insurance 1 Be sure to choose a regular insurance company 2 Traffic insurance is a mustThe insurance types that must be bought are also important to be considered regardless of deductible for car damage. Of course, there are many types of insurance, such as a series of additional insurances such as wading insurance, spontaneous combustion insurance, theft and robbery insurance, because the actual probability of occurrence is negligible.

If the car owner usually drives less often, you can choose insurance based on third-party liability insurance. If the owner often needs to pass through traffic jams when driving, it is recommended to buy separate glass breakage insurance. This kind of insurance is more comprehensive and can be selected according to different situations.

You can not buy scratch insurance, spontaneous combustion insurance, wading insurance and non-deductible insurance. The car owner can choose according to his own financial ability. The second purchase channel is the most cost-effective. The price of car insurance purchased on the official website of the insurance company is the most cost-effective. Generally, it is 15% or 30% cheaper than the purchase through normal channels. Secondly, you can choose a phone car. Risk or go directly to the insurance.

The first method: compare the quotations of different insurance companies. Consumers can enter vehicle information and personal information through the official website of the insurance company or the website of a third-party insurance company to obtain quotations from different insurance companies. Compare the prices and insurance terms of different car insurance companies, and you can choose the most suitable insurance plan for yourself.

Car insurance can be purchased mainly through 4S stores, insurance company business hall, insurance company official website and telephone. If you are not familiar with driving skills and the value is in the middle and low gear, choose a higher third-party liability insurance, and the vehicle personnel liability insurance is more comprehensive. I am not familiar with the driving skills, and the cost of vehicle wear is moderate.

There are many types of car insurance, thisBuy samples to avoid stepping on the pit. As there are more and more vehicles on the street, the probability of traffic accidents is also increasing. In order to protect ourselves, we will choose to buy insurance for vehicles.

I don't think it's cost-effective to buy all of them, but it's not so reassuring not to buy them. Therefore, it is very necessary to understand the function and purchase needs of car insurance, so as to save money and rest assured.

1. The first method: compare the quotations of different insurance companies. Consumers can enter vehicle information and personal information through the official website of the insurance company or the website of a third-party insurance company to obtain quotations from different insurance companies. Compare the prices and insurance terms of different car insurance companies, and you can choose the most suitable insurance plan for yourself.

2. Compare more, choosing full insurance is also a good choice. When buying insurance, compare the prices and services of several insurance companies to find a suitable insurance plan for yourself. Generally speaking, full insurance is the most comprehensive, but the premium is higher. But sometimes, choosing full insurance may be more cost-effective than choosing individual insurance.

3. How to buy car insurance in the most cost-effective way? Novice plan: compulsory insurance + car damage insurance + third-party liability insurance + vehicle personnel liability insurance + non-deductible insurance + separate glass breakage insurance + scratch insurance + can't find a third-party special insurance; this plan is relatively expensive, but it can not only compensate others, but also accidentally commit Mistakes can also protect your own losses.

bingo plus update today Philippines

author: 2025-01-13 14:11UEFA Champions League live streaming app

author: 2025-01-13 13:05Hearthstone arena class win rates reddit

author: 2025-01-13 13:56 Bingo Plus

Bingo Plus

475.24MB

Check Hearthstone arena deck Builder

Hearthstone arena deck Builder

547.42MB

Check bingo plus update today

bingo plus update today

281.83MB

Check UEFA Champions League

UEFA Champions League

428.64MB

Check Arena plus APK

Arena plus APK

539.61MB

Check Arena Plus login

Arena Plus login

991.55MB

Check Casino Plus

Casino Plus

854.56MB

Check DigiPlus

DigiPlus

974.25MB

Check Walletinvestor digi plus

Walletinvestor digi plus

791.15MB

Check Casino Plus login register

Casino Plus login register

577.16MB

Check DigiPlus stock

DigiPlus stock

849.77MB

Check Champions League

Champions League

359.85MB

Check UEFA Europa League

UEFA Europa League

512.96MB

Check 100 free bonus casino no deposit GCash

100 free bonus casino no deposit GCash

693.93MB

Check DigiPlus fair value

DigiPlus fair value

985.78MB

Check UEFA EURO

UEFA EURO

283.89MB

Check Bingo Plus stock

Bingo Plus stock

317.13MB

Check 100 free bonus casino no deposit GCash

100 free bonus casino no deposit GCash

864.52MB

Check Hearthstone Arena win rate

Hearthstone Arena win rate

154.39MB

Check DigiPlus

DigiPlus

127.63MB

Check Hearthstone arena

Hearthstone arena

922.13MB

Check Casino Plus free 100

Casino Plus free 100

147.16MB

Check TNT Sports

TNT Sports

525.65MB

Check European Cup live

European Cup live

861.87MB

Check Casino free 100 no deposit

Casino free 100 no deposit

869.71MB

Check Hearthstone Arena Tier List

Hearthstone Arena Tier List

287.63MB

Check UEFA EURO

UEFA EURO

264.29MB

Check Arena Plus login

Arena Plus login

911.95MB

Check Hearthstone arena

Hearthstone arena

663.72MB

Check UEFA Champions League

UEFA Champions League

561.65MB

Check DigiPlus fair value

DigiPlus fair value

276.16MB

Check Casino Plus app

Casino Plus app

549.23MB

Check Arena plus APK

Arena plus APK

438.67MB

Check UEFA EURO

UEFA EURO

541.54MB

Check Hearthstone arena

Hearthstone arena

324.76MB

Check PAGCOR online casino free 100

PAGCOR online casino free 100

535.67MB

Check

Scan to install

App to watch Champions League live free to discover more

Netizen comments More

1938 DigiPlus

2025-01-13 15:39 recommend

1703 DigiPlus fair value

2025-01-13 15:17 recommend

1068 Walletinvestor digi plus

2025-01-13 14:56 recommend

1570 UEFA EURO

2025-01-13 14:24 recommend

1829 Casino Plus free 100

2025-01-13 13:34 recommend